tucson sales tax rate change

On July 15 2019 the Mayor and the Council of the City of South Tucson. The County sales tax rate is.

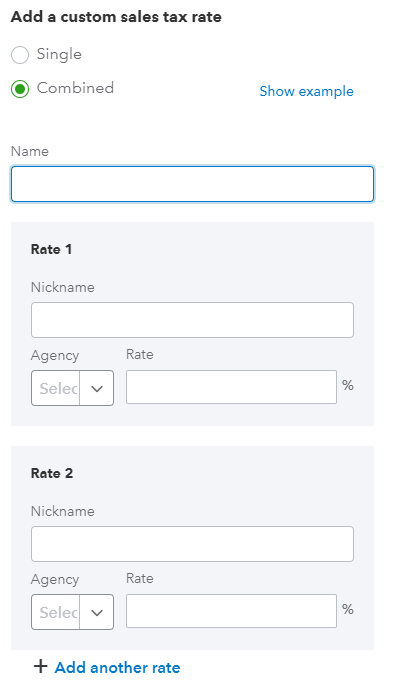

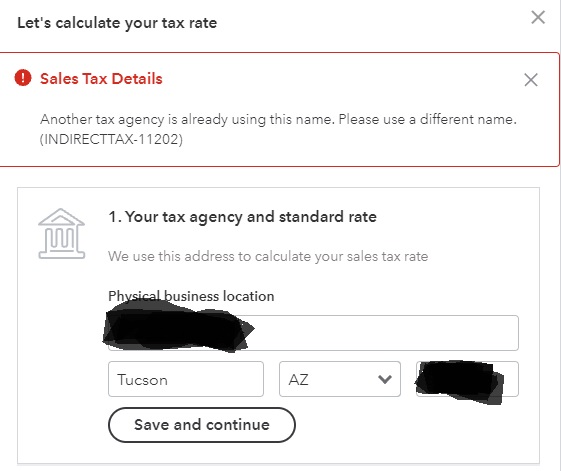

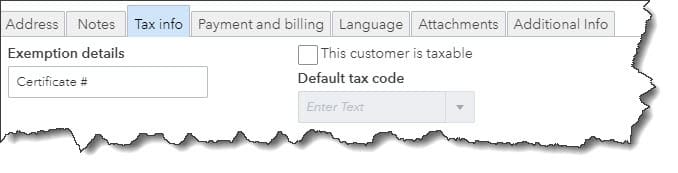

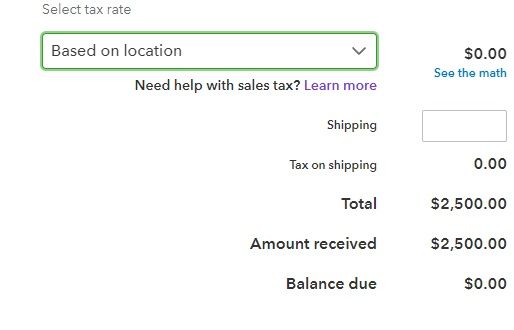

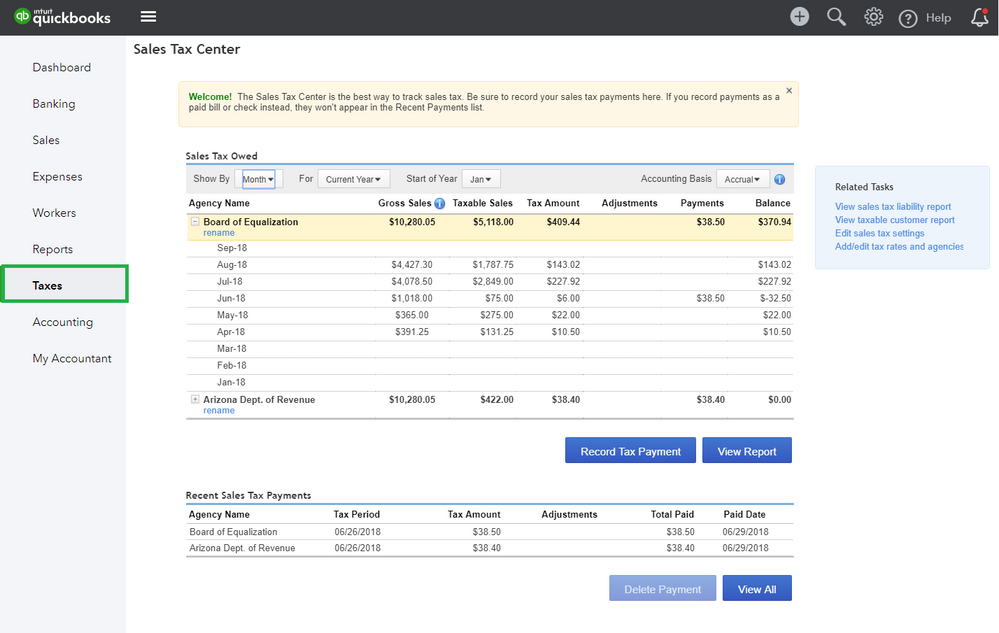

How To Process Sales Tax In Quickbooks Online

Effective July 01 2009 the per room per night surcharge will be 2.

. This information is based on the City of Tucson Business Privilege Tax Code in effect on July 1 2008. 85701 85702 85703. This page will be updated monthly as new sales tax rates are released.

There is no applicable special tax. Has been received by the tax collector. On May 16 2017 Tucson resident voters approved a 5-year half-cent increase to the City of Tucson sales tax rate.

Avalara calculates collects files remits sales tax returns for your business. The South Tucson sales tax rate is. Tucson is located within Pima County Arizona.

Unlike many other cities and towns in the state Tucson does not collect retail sales tax on food or residential rentals. This is the total of state county and city sales tax rates. The Arizona sales tax rate is currently.

However the major cities of Phoenix Mesa and Tucson do not consider groceries taxable. Effective October 1 2019. City of Tucson NOTICE TO TAXPAYERS TAX RATE CHANGES EFFECTIVE FEBRUARY 1 2018 As the result of a Special Election held on November 7 2017 Mayor and Council adopted Ordinance No.

You can find more tax rates and allowances for Tucson and Arizona in the 2022 Arizona Tax Tables. Tucson Sales Tax Rates for 2022. On July 15 2019 the Mayor and the Council of the City of South Tucson approved Ordinance No.

11518 to authorize a voter-approved sales tax increase of one tenth of a percent 01 to fund the Reid Park Zoo Improvement Fund. Effective July 01 2016 the per room per night surcharge will be 4. The County sales tax rate is.

CITY OF SOUTH TUCSON. The following are the tax rate changes effective February 1 2018 and expiring January 31 2028 Use the State of Arizona Department of Revenues Transaction Privilege Use Tax Rate Look Up opens a new window page to find tax rates by address or map. While the state considers groceries tax exempt according to a recent news article all but.

801 Average Sales Tax Summary The average cumulative sales tax rate in Tucson Arizona is 801. The Tucson sales tax rate is. Effective July 01 2016 the per room per night surcharge will be 4.

What is the sales tax rate in South Tucson Arizona. The state sales tax rate in Arizona is 5600. This table lists each changed tax jurisdiction the amount of the change and the towns and cities in which the modified tax rates apply.

Did South Dakota v. Select the Arizona city from the list of cities starting with T below to see its current sales tax rate. The Arizona sales tax rate is currently.

History of Rate Changes. Accordingly effective February 1 2018 the rate rose from 25 to 26 increasing the total retail sales tax rate in Tucson AZ from 86 to 87. Only nine Arizona cities and towns have lower retail sales tax rates.

The December 2020 total local sales tax rate was also 8700. Effective July 1 2017 the rate will rise from 20 to 25 increasing the total retail sales tax rate in Tucson AZ from 81 to 86. While the state considers groceries tax exempt according to a recent news article all but about 20 Arizona cities currently tax grocery items.

This rate change is the result of the November 7th City of Tucson General Election where voters approved Propositions 202 and 203 which authorized a tax increase to support the Reid Park Zoo. Effective July 01 2003 the tax rate increased to 600. In unincorporated Pima County where the sales tax is 61 percent that would only be 9150.

The Tucson Arizona sales tax is 860 consisting of 560 Arizona state sales tax and 300 Tucson local sales taxesThe local sales tax consists of a 050 county sales tax and a 250 city sales tax. Tucson Arizonas Sales Tax Rate is 87. Refer to the official documentation from the Arizona Department of Revenue.

Wayfair Inc affect Arizona. 2022 Arizona Sales Tax Changes Over the past year there have been eighteen local sales tax rate changes in Arizona. This is the total of state county and city sales tax rates.

The minimum combined 2022 sales tax rate for Tucson Arizona is. Please note that effective February 1 2018 the City of Tucson Business Privilege Tax Rate has increased one tenth of a percent to 26 percent. Of Tucson Business Privilege Sales Tax on retail sales.

Currently the City of Tucson receives 2 percent retail sales tax. Tucson Code Section 19-1301 is repealed effective January 01 2015. As UA is exempt from the collection of City of Tucson sales tax for sales made by the UA this change will only apply to purchases from Tucson vendors located within the city limits.

Would you drive an extra mile or two for. Higher sales tax than 68 of Arizona localities 22 lower than the maximum sales tax in AZ The 87 sales tax rate in Tucson consists of 56 Arizona state sales tax 05 Pima County sales tax and 26 Tucson tax. Sales of products directly to the US.

TAX RATE CHANGES EFFECTIVE FEBRUARY 1 2018. Did South Dakota v. The minimum combined 2022 sales tax rate for South Tucson Arizona is.

The Tucson Sales Tax is collected by the merchant on. The current total local sales tax rate in Tucson AZ is 8700. The sales tax jurisdiction name is Arizona which may refer to a local government division.

Sales Tax Breakdown Tucson Details Tucson AZ is in Pima County. Arizona sales tax changes effective January 2020 On January 1 2020 the following Mohave County Navajo County the City of Phoenix and the Town of Kearny will all experience TPT rate changes. This change has no impact on Arizona use tax assessment which remains at 56.

Taxable at one half the regular tax rate. With local taxes the total sales tax rate is between 5600 and 11200. This includes the rates on the state county city and special levels.

The details are too numerous to expound upon here. Within Tucson there are around 52 zip codes with the most populous zip code being 85705. Arizona has recent rate changes Wed Jan 01 2020.

Ad Avalara AvaTax lowers risk by automating sales tax compliance. Tucson in Arizona has a tax rate of 86 for 2022 this includes the Arizona Sales Tax Rate of 56 and Local Sales Tax Rates in Tucson totaling 3. See it in action.

Tucson Arizonas Sales Tax Rate is 87 What is the food tax in Tucson Arizona. What is the sales tax rate in Tucson Arizona. Tucson is in the following zip codes.

New 2022 threshold amounts for the retail sales and use tax two-level tax rate structure as approved by Phoenix voters with Proposition 104 in the August 25 2015 city elections will go into effect January 1 2022.

Solved I Struggled With The Automatic Sales Tax Setup Now I Can T Do My Classwork

Arizona Tax Rates Rankings Arizona State Taxes Tax Foundation

5 Things You Need To Know About Sales Tax In Quickbooks Online

Arizona Tax Rates Rankings Arizona State Taxes Tax Foundation

Arizona Tax Rates Rankings Arizona State Taxes Tax Foundation

Sales Tax Messaging Email Templates Messages Sales Tax

Solved I Struggled With The Automatic Sales Tax Setup Now I Can T Do My Classwork

Prop 411 Tucson Votes To Extend Half Cent Sales Tax In Special Election The Daily Wildcat

Setting Up For Success With Quickbooks Online Sales Tax In Quickbooks Online

How To Charge Sales Tax Vat With Samcart Samcart

Arizona S Combined Sales Tax Rate Is Second Highest In The Nation Cronkite News

Arizona Sales Tax Rates By City County 2022

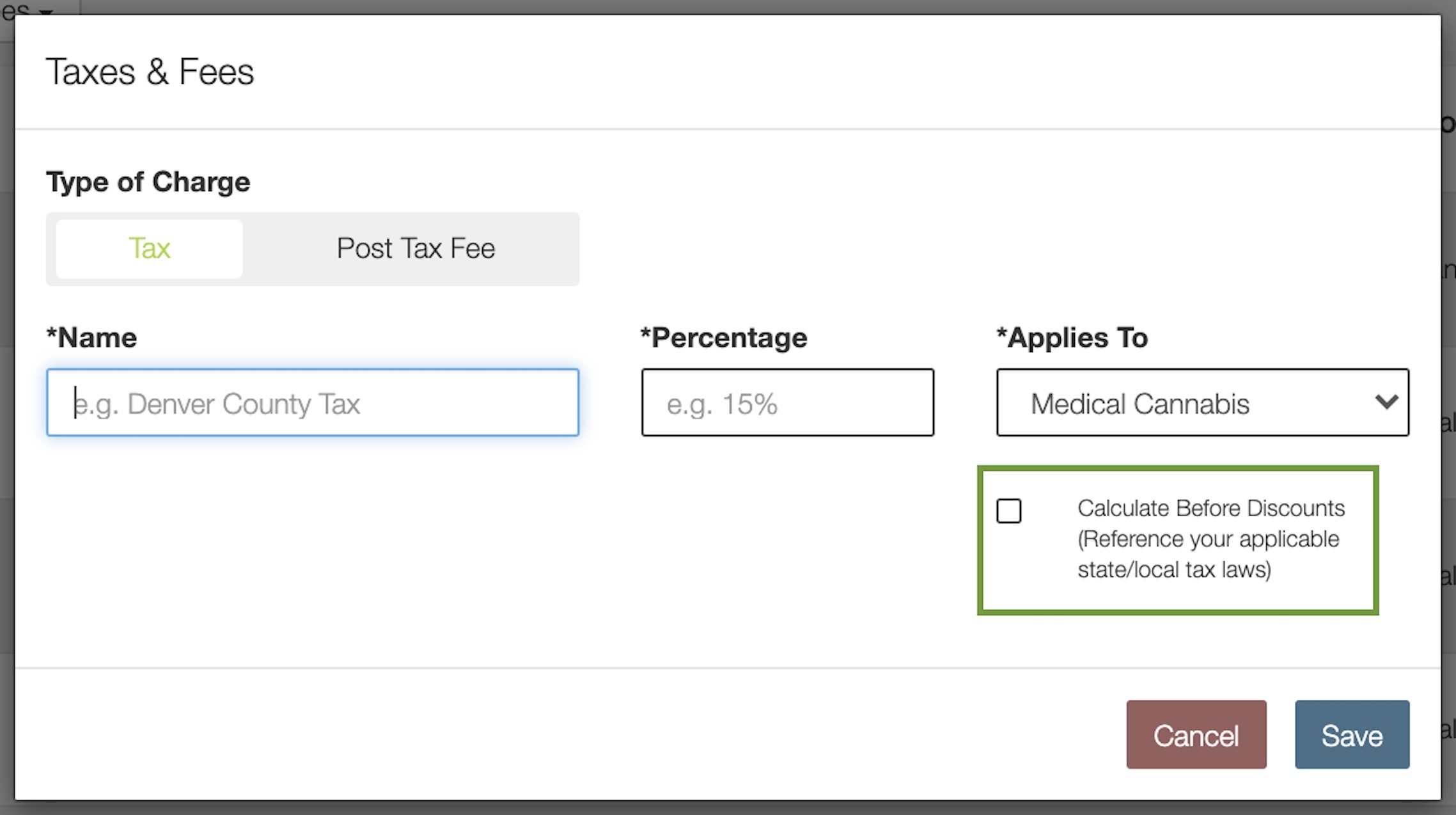

How To Calculate Cannabis Taxes At Your Dispensary

Arizona Tax Rates Rankings Arizona State Taxes Tax Foundation

How To Calculate Sales Tax For Your Online Store

Arizona Tax Rates Rankings Arizona State Taxes Tax Foundation

Property Taxes In Arizona Lexology